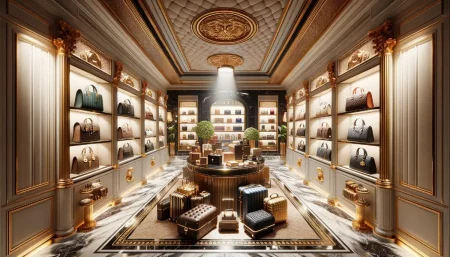

The latest trend? Investing in luxury assets. From fine art and classic cars to rare wines and high-end real estate, these investments are not only a status symbol but also offer significant financial returns. Let’s delve into the world of luxury investments and explore how the wealthy are using them to enhance their wealth management strategies.

The Allure of Luxury Investments

Tangible and Intrinsic Value

Unlike stocks or bonds, luxury assets have tangible value. They are physical items that one can see, touch, and enjoy. This intrinsic value can be particularly appealing during times of economic uncertainty. Luxury assets often appreciate in value over time, making them a reliable store of wealth.

Aesthetic and Emotional Appeal

Luxury investments are not just about financial returns; they also offer aesthetic and emotional rewards. Owning a Picasso painting, a vintage Ferrari, or a collection of rare Bordeaux wines provides a sense of pride and pleasure that traditional investments cannot match. This emotional connection can make luxury investments particularly satisfying for affluent individuals.

Diversification and Risk Management

Luxury assets often have a low correlation with traditional financial markets, making them an excellent diversification tool. By incorporating high-end assets into their portfolios, investors can reduce their overall risk. During market downturns, luxury investments can hold their value or even appreciate, providing a hedge against economic volatility.

Types of Luxury Investments

Fine Art

Investing in fine art has been a favored strategy among the wealthy for centuries. Masterpieces by artists like Leonardo da Vinci, Vincent van Gogh, and Pablo Picasso can fetch millions at auction and often appreciate over time. Contemporary art is also gaining popularity, with works by artists like Banksy and Jeff Koons commanding high prices.

Example: In 2017, Leonardo da Vinci’s painting “Salvator Mundi” sold for a record-breaking $450 million at Christie’s auction house, illustrating the immense value and potential return of fine art investments.

Classic Cars

Classic and vintage cars are another popular luxury investment. Rare models from brands like Ferrari, Aston Martin, and Bugatti have seen substantial appreciation in value. Collectors often view these cars as pieces of history and works of art.

Real-Life Story: In 2018, a 1962 Ferrari 250 GTO sold for $48.4 million, setting a world record for the most expensive car ever sold at auction. The previous owner had purchased the car for $10 million in 2000, showcasing the significant return on investment.

Rare Wines

Investing in fine wines is not only a connoisseur’s delight but also a lucrative venture. Rare and vintage wines from renowned vineyards can appreciate significantly over time. The wine market has shown consistent growth, driven by increasing global demand and limited supply.

Market Insight: According to the Liv-ex Fine Wine 1000 Index, which tracks the price performance of fine wines, the market has shown steady growth, with particular strength in Bordeaux and Burgundy wines.

High-End Real Estate

Luxury real estate remains a cornerstone of wealth preservation and growth. Properties in prime locations such as Manhattan, London, and Beverly Hills are highly sought after. These properties not only appreciate in value but also generate rental income, providing a steady cash flow.

Example: The real estate market in Monaco, known for its exclusivity and high property values, has seen prices rise steadily. According to Savills, the average price per square meter in Monaco reached €48,800 in 2020, making it one of the most expensive real estate markets in the world.

Considerations for Luxury Investing

Expertise and Knowledge

Investing in luxury assets requires a deep understanding of the market and the specific asset class. Whether it’s art, cars, wine, or real estate, having expert knowledge or consulting with specialists is crucial. This expertise can help investors identify valuable opportunities and avoid potential pitfalls.

Liquidity and Market Demand

Luxury investments can be less liquid than traditional assets. Selling a rare painting or a vintage car might take time, and the market demand can fluctuate. Investors need to be prepared for these factors and consider the long-term horizon of their investments.

Provenance and Authenticity

The value of luxury goods often depends on their provenance and authenticity. Ensuring that an asset has a clear history and is verified as authentic is essential. This verification process can involve extensive research and the use of experts, particularly in markets like fine art and vintage cars.

Storage and Maintenance

Luxury goods and assets often require special storage and maintenance. Fine art needs climate-controlled environments, classic cars require regular upkeep, and wine must be stored in optimal conditions. These factors add to the cost of owning luxury investments and should be considered when calculating potential returns.

Getting Started with Luxury Investments

Consult with Experts

Before diving into luxury investments, it’s advisable to consult with experts in the field. Art advisors, classic car specialists, wine merchants, and real estate consultants can provide valuable insights and help navigate the complexities of these markets.

Start Small

For those new to luxury investing, starting with smaller, more manageable investments can be a wise strategy. This approach allows investors to gain experience and understanding of the market dynamics without committing large sums of money upfront.

Attend Auctions and Events

Participating in auctions and attending industry events can be an excellent way to learn about the luxury investment market. These venues offer opportunities to see high-end assets firsthand, meet experts, and observe market trends.

Diversify

As with any investment strategy, diversification is key. Spreading investments across different types of luxury assets can reduce risk and increase the potential for returns. A balanced portfolio might include a mix of fine art, classic cars, rare wines, and high-end real estate.

Conclusion

Luxury investments offer affluent individuals a unique way to diversify their portfolios and enhance their wealth management strategies. With their tangible value, aesthetic appeal, and potential for high returns, assets like fine art, classic cars, rare wines, and luxury real estate are becoming increasingly popular among the wealthy. However, these investments require expertise, careful consideration, and a long-term perspective. By consulting with specialists, starting small, and diversifying, investors can successfully navigate the world of luxury investments and enjoy both financial and personal rewards.

What are luxury investments?

Luxury investments refer to assets that are considered high-end or exclusive, such as fine art, classic cars, rare wines, and luxury real estate. These investments are typically valued not only for their potential financial returns but also for their aesthetic and intrinsic value. They often require significant expertise to manage and can provide diversification benefits to an investment portfolio.

How do I start investing in luxury assets?

To start investing in luxury assets, it’s crucial to first educate yourself about the specific market you are interested in. Consulting with experts, such as art advisors, classic car specialists, wine merchants, and real estate consultants, can provide valuable insights. Starting with smaller, manageable investments can help you gain experience. Attending auctions, industry events, and engaging with the community can also provide a deeper understanding of market trends and opportunities.

What are the risks associated with luxury investments?

Luxury investments come with unique risks, including lower liquidity, market demand fluctuations, and the need for proper storage and maintenance. Ensuring the provenance and authenticity of luxury assets is crucial to their value. Additionally, these investments often require a long-term perspective and can involve higher transaction costs. Consulting with specialists and conducting thorough research can help mitigate these risks.