In the ever-evolving world of digital finance, cryptocurrency stands as a beacon of innovation and potential. Yet, with great innovation comes great scrutiny. Governments and regulatory bodies across the globe are grappling with the challenges and opportunities that cryptocurrencies present. From Bitcoin’s meteoric rise to the emergence of thousands of altcoins, the crypto landscape is as diverse as it is complex. As we delve into the intricate web of cryptocurrency regulations, we’ll explore the current state of affairs, upcoming changes, and the impact on investors, traders, and the broader financial ecosystem.

Current Regulations Across Major Countries

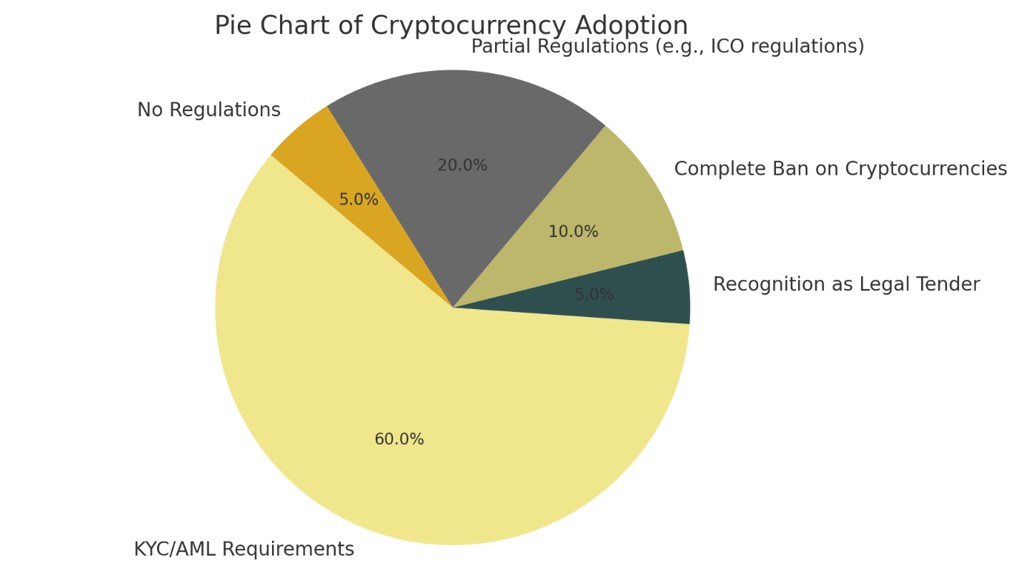

United States: The U.S. has a multifaceted approach to cryptocurrency regulation. The SEC oversees crypto as securities, the CFTC as commodities, and the IRS treats them as property for tax purposes. The Financial Crimes Enforcement Network (FinCEN) monitors for money laundering.

European Union: The EU introduced the 5th Anti-Money Laundering Directive (5AMLD) that requires crypto exchanges and wallet providers to follow KYC procedures. The upcoming Markets in Crypto-Assets (MiCA) regulation aims to provide a comprehensive framework.

China: China has taken a strict stance, banning Initial Coin Offerings (ICOs) and crypto exchanges. The People’s Bank of China is actively working on a digital Yuan, reflecting a controlled approach to digital currency.

India: India’s regulatory landscape is marked by uncertainty. While the Reserve Bank of India had imposed a banking ban on crypto, the Supreme Court lifted it in 2020. New legislation is under discussion, which may define the future course.

Japan: Japan is among the first to recognize Bitcoin as legal tender. The Financial Services Agency (FSA) regulates exchanges, ensuring compliance with stringent rules.

The adoption of various cryptocurrency regulatory frameworks

Upcoming Regulations and Their Impact

The global regulatory landscape is shifting towards more clarity and compliance. Key upcoming regulations include:

- Global Stablecoin Regulations: The Financial Stability Board (FSB) has proposed guidelines for regulating global stablecoins like Tether. It emphasizes risk management and operational resilience.

- EU’s MiCA Regulation: The MiCA aims to create a harmonized framework for crypto-assets across EU member states, fostering innovation while ensuring consumer protection.

- S. Crypto Tax Clarity: The U.S. is working on clear tax guidelines for crypto transactions, aiming to simplify reporting and compliance.

- Regulation of Decentralized Finance (DeFi): DeFi platforms are on regulatory radars, with discussions around applying traditional financial rules to decentralized systems.

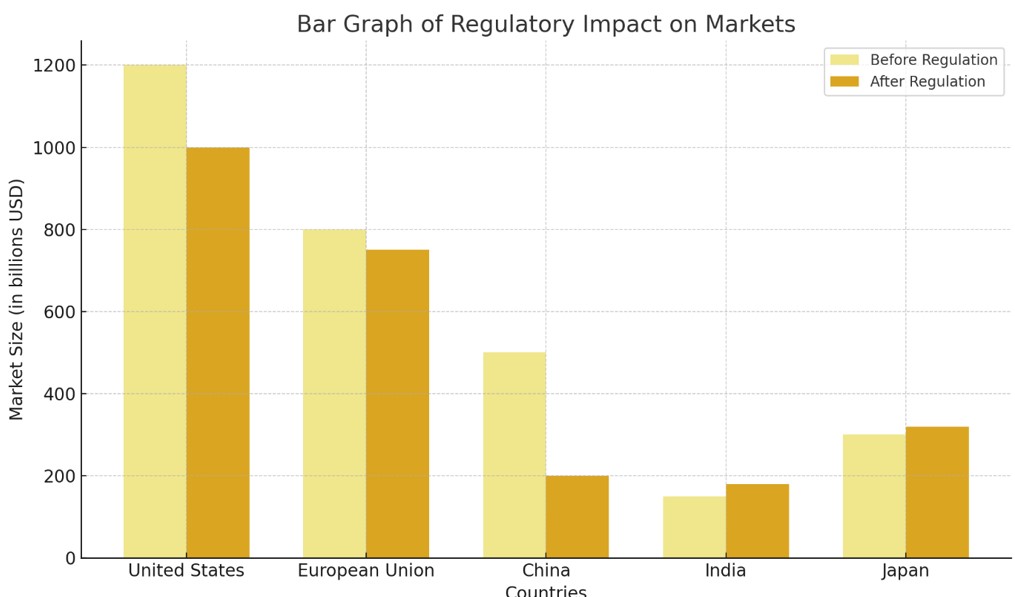

Regulatory Impact on Markets

The graph shows the market size (in billions USD) before and after significant regulatory changes.

Interesting Fact

Did you know that El Salvador became the first country to adopt Bitcoin as legal tender in 2021? This bold move has sparked global debate and inspired other nations to consider similar measures.

The Balancing Act: Innovation vs. Regulation

Regulating cryptocurrencies is a complex task that requires a delicate balance. On one hand, regulations are necessary to prevent fraud, protect consumers, and ensure financial stability. On the other hand, overly strict regulations can stifle innovation and hinder the growth of a potentially transformative technology.

Example: South Korea’s Regulatory Evolution South Korea initially embraced cryptocurrency with a booming market. However, concerns over fraud and security led to stringent regulations, including a ban on anonymous trading. The result was a significant market contraction. Over time, the regulations have evolved to support legitimate businesses, showing how a balanced approach can foster growth while mitigating risks.

The Role of Self-Regulation

In the absence of clear governmental guidelines, some crypto businesses have turned to self-regulation. Industry associations and collaborations are working to establish best practices.

Example: Japan’s Virtual Currency Exchange Association (JVCEA) The JVCEA is a self-regulatory organization that enforces rules on security, consumer protection, and compliance among its member exchanges. This proactive approach has helped build trust and may influence official regulations.

The Challenge of Decentralized Systems

Regulating decentralized systems like DeFi platforms presents unique challenges. Traditional regulatory approaches may not apply, and there’s a need for innovative solutions.

Example: The DeFi Regulatory Sandbox Some jurisdictions are considering regulatory sandboxes for DeFi projects. These controlled environments allow experimentation under regulatory supervision, providing insights into how decentralized systems can be governed.

Final Thoughts

The regulatory landscape for cryptocurrencies is dynamic and multifaceted. As governments and regulators grapple with the challenges of a rapidly evolving technology, the path forward requires collaboration, innovation, and a willingness to adapt. The balance between fostering growth and ensuring safety is delicate but achievable. The examples and insights shared in this article highlight the complexity of the task and the innovative solutions being explored.

With regulations continuing to shape the future of cryptocurrencies, staying informed and engaged with the latest developments is essential for investors, businesses, and policymakers alike.

Sudden regulatory changes can lead to price volatility. Positive regulations may boost prices, while restrictive measures can lead to declines.

While regulations can reduce risks, they cannot eliminate them entirely. Vigilance and due diligence by users remain crucial.

Emerging markets vary widely in their approach. Some, like Brazil, are embracing crypto with clear regulations, while others remain cautious or restrictive.